In the fast-paced world of finance, it’s imperative to keep a close eye on key levels in the market. Navigating the stock market requires a keen understanding of technical analysis and a strategic approach to risk management. As the Nifty consolidates, traders must be vigilant and mindful of crucial levels to avoid potential pitfalls and capitalize on opportunities.

Support and resistance levels play a vital role in determining the direction of a stock or an index. When the Nifty is consolidating, traders should pay attention to these levels as they provide important insights into potential entry and exit points. By keeping a close watch on these levels, traders can make informed decisions and adjust their strategies accordingly.

Another crucial factor to consider while the Nifty consolidates is market sentiment. Sentiment analysis involves gauging the mood of market participants to anticipate potential market movements. By monitoring market sentiment through indicators such as the put-call ratio, traders can gain valuable insights into market dynamics and position themselves strategically.

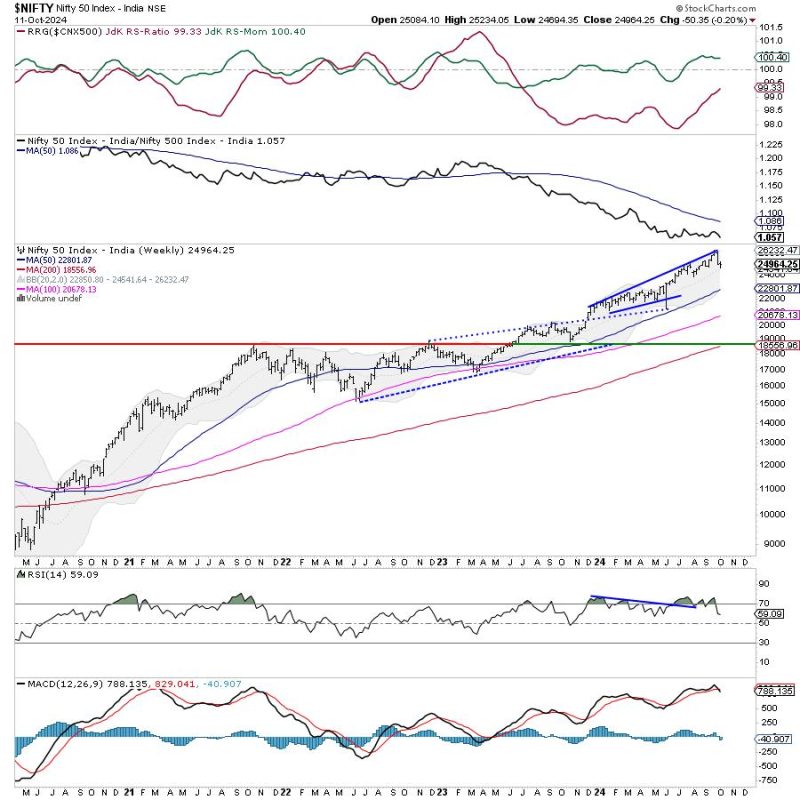

Technical indicators also play a significant role in navigating the market during consolidation phases. Moving averages, MACD, RSI, and other technical tools can provide valuable signals and confirmations of market trends. By incorporating technical analysis into their trading strategies, traders can enhance their decision-making process and increase the probability of successful trades.

Furthermore, risk management should be a top priority for traders during a consolidation phase. Setting stop-loss orders, managing position sizes, and diversifying portfolios are essential risk management strategies that can help traders mitigate potential losses and protect their capital. By implementing effective risk management techniques, traders can safeguard their investments and sustain long-term profitability.

In conclusion, navigating the stock market during a consolidation phase requires a strategic and disciplined approach. By monitoring key levels, analyzing market sentiment, utilizing technical indicators, and implementing risk management strategies, traders can position themselves for success in a volatile market environment. Stay informed, stay vigilant, and stay ahead of the game to maximize opportunities and mitigate risks in the ever-changing landscape of the stock market.