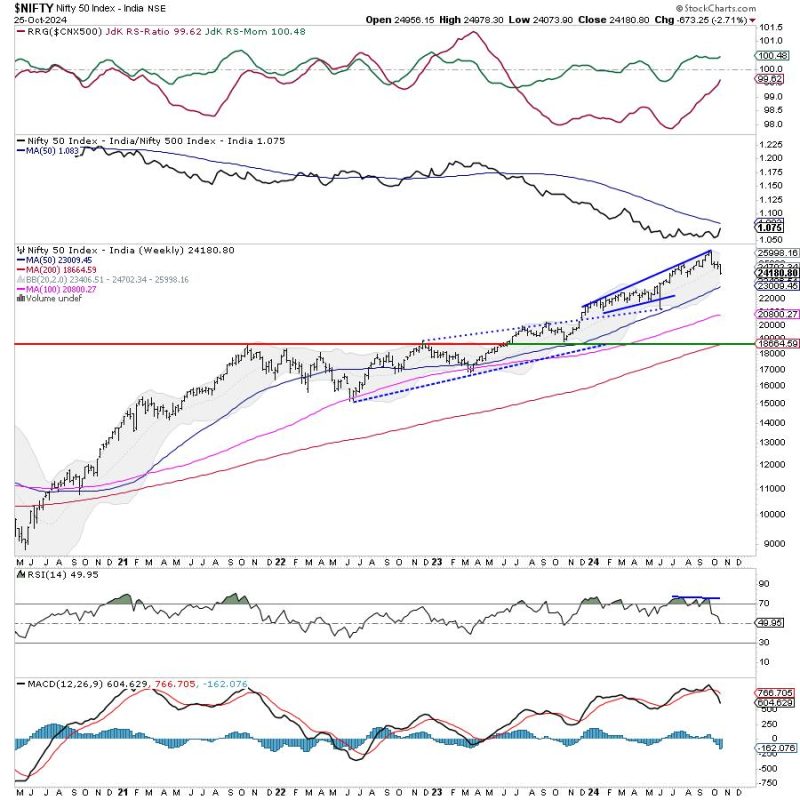

The Nifty 50 Index (Nifty) has experienced a tumultuous week, with key support levels being breached, exerting downward pressure on resistance levels. The market’s performance over the past week demonstrates the volatile nature of the Nifty and underscores the challenges that investors and traders face in navigating the current economic environment.

Technical analysis of the Nifty reveals that the index has breached key support levels, which has the potential to signal further downside momentum. The violation of these support levels indicates a weakening in market sentiment and suggests that bearish forces may be in control in the near term. Investors should closely monitor these support levels to gauge the index’s next potential moves and evaluate their investment strategies accordingly.

Furthermore, the downward pressure on resistance levels has created a challenging environment for the Nifty to break through and establish positive momentum. The resistance levels act as barriers for the index to move higher, and the failure to breach these levels indicates a lack of strong buying interest in the market. Traders should pay close attention to how the Nifty interacts with these resistance levels to anticipate potential price movements and adjust their trading strategies accordingly.

The Nifty’s performance over the past week also reflects broader market trends and external factors that are influencing investor sentiment. Economic uncertainties, geopolitical tensions, and global market volatility have all contributed to the erratic behavior of the Nifty, highlighting the need for investors to stay informed and adaptable in their decision-making process.

In conclusion, the Nifty’s violation of key support levels and struggles with resistance highlight the challenges that investors and traders face in navigating the current market environment. By closely monitoring these technical levels and staying informed about broader market trends, investors can better position themselves to make well-informed decisions and navigate the volatile landscape of the Nifty with greater confidence.