The week ahead promises to be filled with intrigue and excitement as investors brace themselves for potential market movements. With all eyes fixed on the market, particularly the Nifty index, it becomes crucial to analyze its performance from various perspectives to make well-informed decisions.

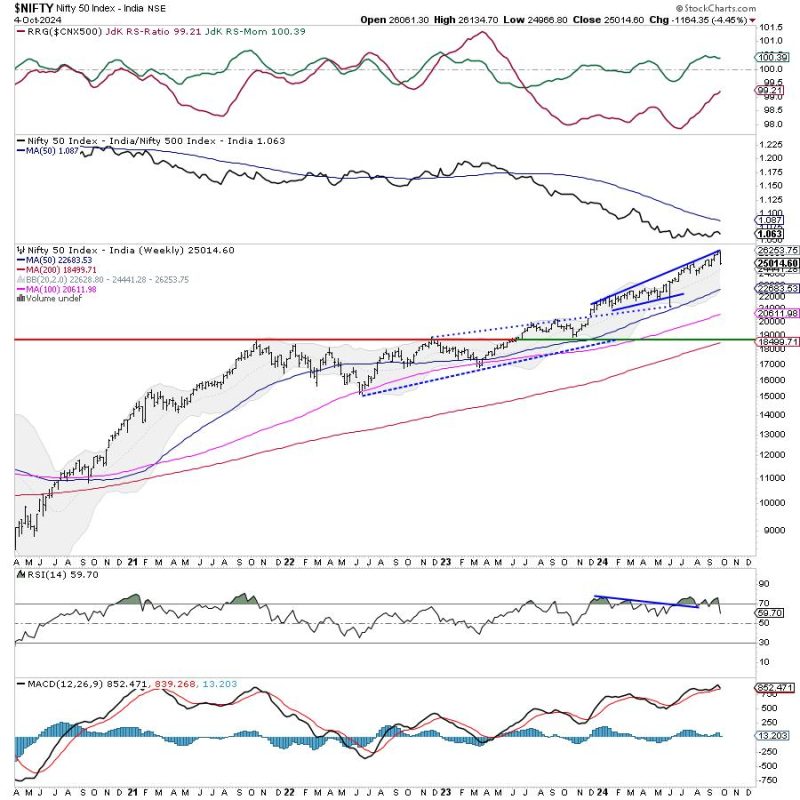

One primary angle to consider is the technical analysis of the Nifty chart. By examining key support and resistance levels, trend lines, and patterns, analysts can glean valuable insights into potential price movements. Traders may look for breakout or breakdown points to confirm trends and anticipate future price action accurately.

Another crucial perspective to watch is the macroeconomic landscape. Factors such as interest rates, inflation, GDP growth, and geopolitical events play a significant role in shaping market sentiment and driving price movements. Investors should stay attuned to relevant economic indicators and news to gauge the overall health of the economy and potential market impact.

Additionally, sentiment analysis can provide valuable clues about market behavior. Tracking investor sentiment through tools like the put-call ratio, investor surveys, and social media chatter can help gauge market sentiment and identify potential turning points. Contrarian indicators like excessive bullish or bearish sentiment can signal potential market reversals.

It is also essential to consider the broader market context when analyzing the Nifty index. Intermarket analysis, which examines the relationships between different asset classes like stocks, bonds, commodities, and currencies, can offer valuable insights into overall market trends and potential divergences that may impact the Nifty’s performance.

Furthermore, keeping an eye on sector rotations and market breadth can provide a more comprehensive view of market dynamics. Strong performance in specific sectors may indicate underlying market strength, while divergences in market breadth could signal potential weakness or rotation within the market.

In conclusion, by adopting a multifaceted approach and considering various perspectives, investors can gain a deeper understanding of the market and make more informed trading decisions. Whether through technical analysis, macroeconomic insights, sentiment analysis, intermarket relationships, or sector rotations, a holistic view of the market can help navigate the complexities of the week ahead and seize profitable opportunities.