Certainly! Here is a unique and well-structured article based on the reference link you provided:

The S&P 500 index is widely regarded as a barometer of the stock market’s overall health and performance. Investors are constantly watching this index for signs of bullish or bearish trends that may impact their investment decisions. The recent surge in stock prices has led to speculation among market participants that the S&P 500 may soon surpass the 6000 mark. However, there are several key factors that suggest the index may not break 6000 just yet.

One major factor to consider is the current economic environment. While the US economy has shown signs of recovery following the COVID-19 pandemic, there are still uncertainties and challenges that could hinder the S&P 500 from reaching new highs. Factors such as inflation, supply chain disruptions, and geopolitical tensions could weigh on investor sentiment and limit the index’s upward momentum.

Another important consideration is valuation. The S&P 500 has already experienced significant gains in recent years, leading to lofty valuations for many stocks in the index. Some analysts believe that price-to-earnings ratios are stretched, indicating that stocks may be overvalued compared to their earnings potential. This could make it more difficult for the index to sustain a move above 6000 without a significant correction in stock prices.

Furthermore, the Federal Reserve’s monetary policy decisions could also impact the trajectory of the S&P 500. The central bank has signaled its intention to gradually tighten monetary policy in response to rising inflationary pressures. This could lead to higher interest rates, which may dampen investor enthusiasm for equities and potentially lead to a sell-off in the stock market.

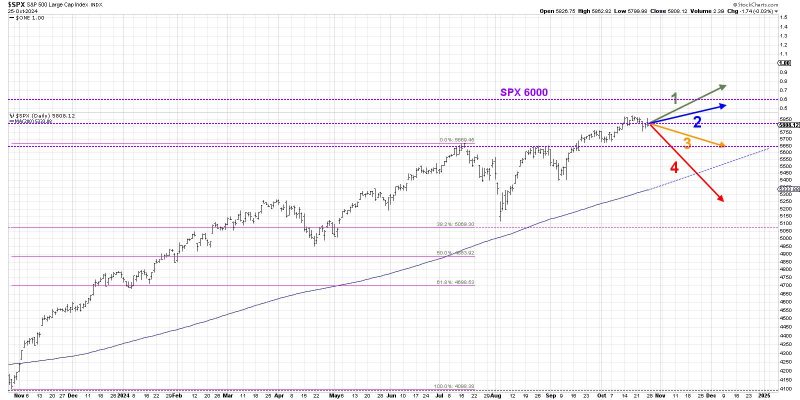

In addition to these factors, technical analysis of the S&P 500’s price chart suggests that there may be resistance around the 6000 level. Previous highs and psychological barriers could create a challenging hurdle for the index to overcome in the near term. Without a strong catalyst or fundamental driver to propel stock prices higher, the S&P 500 may struggle to break through this key level.

In conclusion, while the stock market has experienced significant gains in recent years, there are several reasons to believe that the S&P 500 may not break 6000 just yet. Economic uncertainties, stretched valuations, monetary policy decisions, and technical resistance all suggest that the index could face headwinds in its quest for new highs. Investors should closely monitor these factors and exercise caution in their investment decisions to navigate the evolving market landscape.