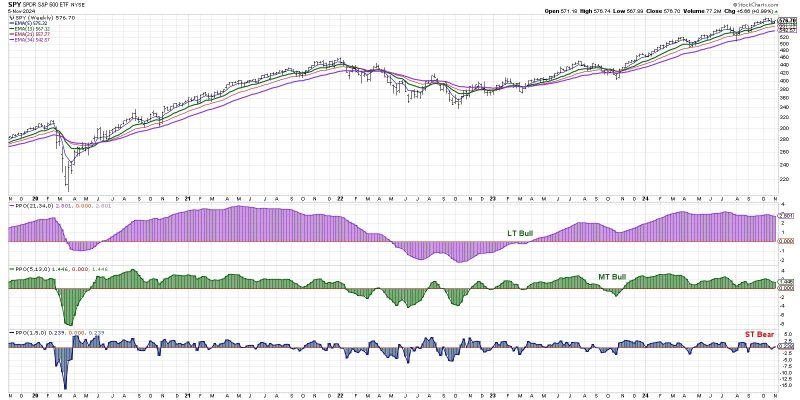

The recent market volatility has sent shockwaves throughout the financial world as investors brace for a news-heavy week ahead. With a short-term bearish signal looming, traders are on high alert as they navigate uncertain waters in search of potential opportunities.

One key factor contributing to the current market sentiment is the ongoing geopolitical tensions between major global powers. Trade disputes, political unrest, and economic uncertainty have all played a role in causing fluctuations in the markets. Investors are closely monitoring developments in these areas to gauge their potential impact on asset prices.

Additionally, the upcoming release of key economic data and corporate earnings reports is expected to further influence market dynamics. Analysts are forecasting that these announcements could provide valuable insights into the overall health of the economy and individual companies, which in turn could sway investor sentiment.

Amidst this environment of uncertainty, traders are urged to exercise caution and remain vigilant in their decision-making processes. Proper risk management strategies, such as setting stop-loss orders and diversifying portfolios, can help protect against potential losses while also capitalizing on emerging opportunities.

Furthermore, staying informed and up-to-date with the latest news and market developments is crucial for navigating volatile market conditions. By continuously monitoring market trends and staying abreast of relevant news, investors can make more informed decisions and adapt their strategies accordingly.

In conclusion, while the short-term bearish signal may be cause for concern, it also presents an opportunity for traders to reassess their investment strategies and adjust their positions accordingly. By staying informed, exercising caution, and implementing effective risk management techniques, investors can weather the storm and potentially capitalize on the market’s fluctuations.