Investing in Chromium Stocks: A Guide for Beginners

Understanding the Chromium Market

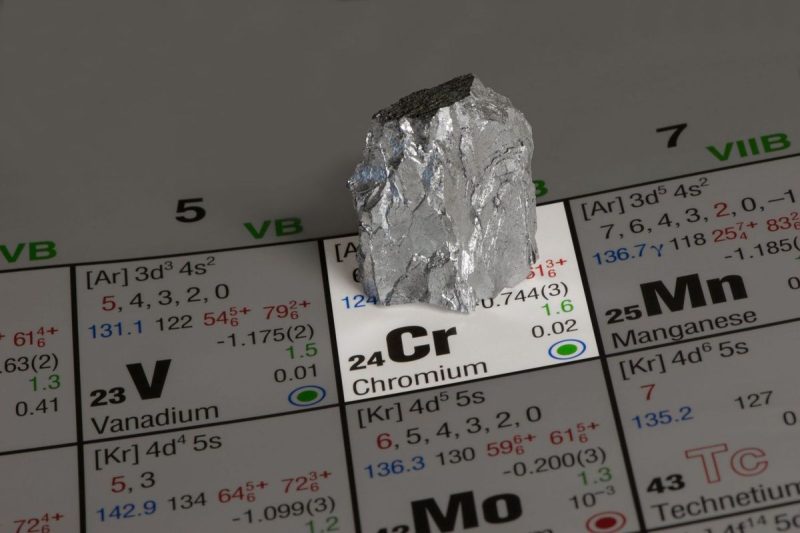

Chromium is a versatile metal that is widely used in various industries, including stainless steel production, automotive manufacturing, and aerospace. It is highly valued for its corrosion resistance and durability, making it an essential component in many high-demand industries. As the global economy continues to grow, the demand for chromium is expected to rise steadily, presenting a lucrative opportunity for investors.

Factors Affecting Chromium Prices

Several factors influence the price of chromium, making it essential for investors to stay informed and make strategic decisions. The supply and demand dynamics play a significant role in determining market prices. Political stability in major chromium-producing countries, such as South Africa, Kazakhstan, and India, can also impact prices. Additionally, changes in global economic conditions and technological advancements can affect the demand for chromium and subsequently its market value.

Choosing the Right Investment Strategy

Investing in chromium stocks can be a profitable venture, but it requires a thorough understanding of the market and careful planning. Investors can choose to invest directly in companies involved in chromium mining and production or opt for exchange-traded funds (ETFs) that focus on metals and mining industries. Additionally, investing in commodities futures can allow investors to profit from fluctuations in chromium prices without owning the physical metal.

Diversifying Your Portfolio

Diversification is key to building a resilient investment portfolio. While chromium stocks can offer attractive returns, it is essential to spread your investments across different sectors and asset classes to minimize risk. By diversifying your portfolio, you can protect yourself against market volatility and potentially increase your overall returns over time.

Risks and Challenges

Like any investment, investing in chromium stocks comes with its own set of risks and challenges. Fluctuations in global economic conditions, geopolitical tensions, and changes in industry regulations can all impact the value of chromium stocks. It is crucial for investors to stay informed, conduct thorough research, and seek advice from financial professionals to navigate these risks successfully.

Long-Term Growth Potential

Despite the inherent risks, investing in chromium stocks can offer significant long-term growth potential. As industries continue to expand and technological advancements drive demand for chromium-based products, the outlook for chromium stocks remains positive. By taking a strategic approach to investing and staying informed about market trends, investors can capitalize on the growth opportunities in the chromium market.

In conclusion, investing in chromium stocks can be a rewarding endeavor for investors seeking to capitalize on the metal’s unique properties and widespread applications. By understanding the market dynamics, choosing the right investment strategy, diversifying your portfolio, and managing risks effectively, you can position yourself for long-term growth and financial success in the chromium market.