The article discusses the potential for a rally in the USD and its implications. Let’s dive deeper into the factors that could contribute to the strengthening of the USD in the near future.

Factors Influencing the USD Rally

1. Economic Recovery: The USD may see a rally as the U.S. economy continues to recover from the impacts of the COVID-19 pandemic. With increasing vaccination rates and stimulus packages in place, economic indicators such as GDP growth and employment rates are showing signs of improvement. This positive economic outlook could attract investors to the USD.

2. Federal Reserve Policy: The U.S. Federal Reserve plays a crucial role in influencing the value of the USD through its monetary policy decisions. As the economy strengthens, the Fed may start considering tapering its asset purchase program and eventually raise interest rates to prevent overheating. Such actions could boost the USD as higher interest rates make U.S. assets more attractive to investors.

3. Inflation Concerns: Inflationary pressures have been a major concern in the current economic environment. The USD tends to perform well during periods of rising inflation as it is seen as a safe-haven currency. Investors may flock to the USD as a hedge against inflation, further supporting its rally.

4. Global Events and Geopolitical Risks: Geopolitical tensions, trade disputes, and other global events can also impact the value of the USD. Uncertainties in other major economies or regions may drive investors towards the stability of the USD, leading to a rally in its value.

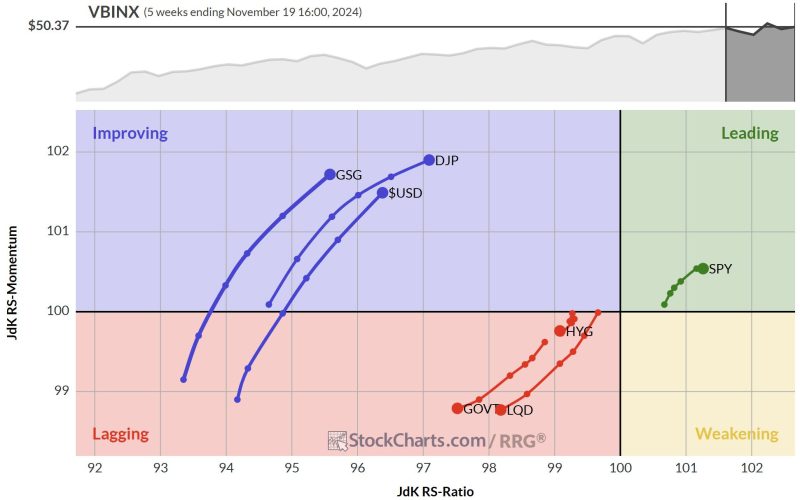

5. Technical Analysis: Traders often rely on technical analysis to predict market trends. By analyzing historical price movements and chart patterns, traders can identify potential entry and exit points for their trades. Technical indicators may currently be signaling a bullish trend for the USD, further fuelling expectations of a rally.

Conclusion

The USD’s potential rally could have far-reaching implications for global markets, impacting commodities, equities, and other currencies. It is essential for investors and traders to stay informed about the latest economic developments and central bank policies to navigate the currency markets effectively. While the USD’s rally is not guaranteed, the factors outlined above suggest a plausible scenario for its strengthening in the foreseeable future.