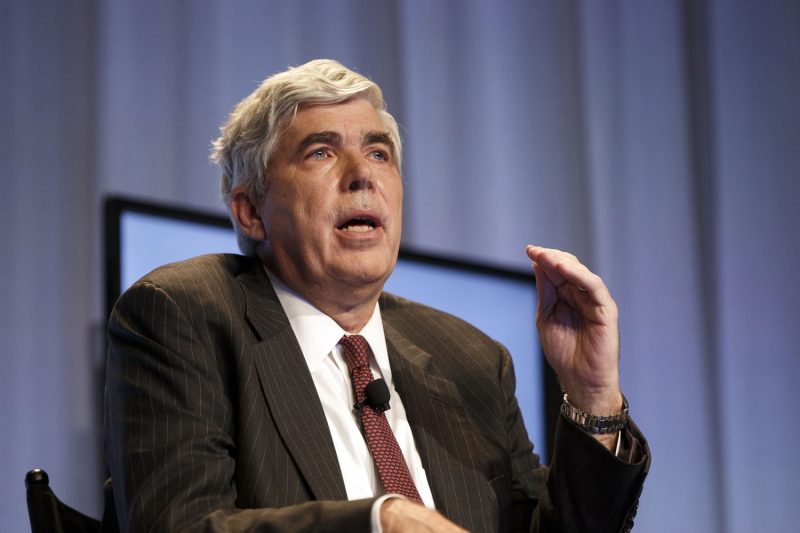

Kenneth Leech, a former executive at Wamco, a multinational financial services company, has been charged with fraud in the United States. The allegations brought against him paint a grim picture of financial misconduct and deception, revealing the potential for significant repercussions in the corporate landscape.

The charges leveled against Leech stem from his alleged involvement in a fraudulent scheme that aimed to deceive investors and regulators about the true financial health of Wamco. According to the authorities, Leech orchestrated a series of deceitful practices, including manipulating financial data, fabricating documents, and providing false information to stakeholders. These actions not only undermined the trust of investors but also threatened the integrity of the financial markets.

The ramifications of Leech’s alleged fraudulent activities could extend far beyond the immediate consequences for Wamco. The scandal has the potential to erode investor confidence in the broader financial industry, leading to increased scrutiny and distrust of corporate entities. Moreover, the fallout from such misconduct could have a ripple effect on the economy, affecting market stability and investor sentiment.

This case serves as a stark reminder of the importance of transparency and accountability in corporate governance. It underscores the critical need for robust regulatory oversight and effective enforcement mechanisms to prevent and deter fraudulent behavior. By holding individuals like Kenneth Leech accountable for their actions, authorities send a clear message that financial fraud will not be tolerated and that those who engage in such practices will face severe consequences.

In light of these developments, it is essential for companies to prioritize ethical conduct, integrity, and compliance with regulations. Maintaining a culture of transparency and honesty within organizations is crucial for safeguarding the interests of investors, employees, and other stakeholders. By upholding high standards of corporate governance and ethics, companies can build trust, enhance their reputation, and contribute to a healthier and more resilient financial ecosystem.

As the legal proceedings against Kenneth Leech unfold, the case is likely to draw significant attention and scrutiny from the public, regulators, and the wider business community. It serves as a cautionary tale about the dangers of financial misconduct and the imperative of upholding ethical standards in the corporate world. Ultimately, the outcome of this case will not only impact the individuals directly involved but also reverberate throughout the financial industry, influencing attitudes and behaviors towards integrity and accountability.